The Future of Physical Retail in 2026

Nine Predictions Shaping the Next Era of Store-Led Growth

Physical Retail Is Not “Back”, It’s Being Rewritten

If the last decade was about proving that physical retail still matters, 2026 is about redefining why it exists at all.

The question is no longer “Will stores survive?” That debate is over. Physical retail is here, but it is not neutral, not passive, and not optional. Stores that fail to evolve will quietly disappear, while those that understand their new role will become the most powerful asset a retailer owns.

After years of ecommerce acceleration, cost-of-living pressure, AI disruption and shifting consumer expectations, physical retail is entering a new phase. One where experience trumps efficiency, emotion outweighs convenience, and clarity beats scale.

In 2026, stores will no longer exist simply to sell product. They will exist to:

• Acquire customers more efficiently

• Deepen emotional loyalty

• Signal brand values

• Act as fulfilment infrastructure

• Anchor communities

• And increasingly, justify their own footprint

Here are nine predictions for physical retail in 2026 - not from a place of hype, but from what we’re seeing on the ground, in data, and in conversations with retailers who are already adapting.

CAMP, A Family Experience Store: Trolls x Camp

Prediction #1: The Transactional Store Will Become Obsolete

By 2026, stores that exist purely to transact will struggle to justify their rent.

If a store offers nothing more than product on shelves, predictable layouts and a checkout, it is competing directly with ecommerce - and losing. Consumers already know they can buy faster, cheaper and with less friction online.

Physical retail must now answer a harder question: “Why is this worth leaving the house for?”

Successful stores will prioritise:

• Discovery over density

• Interaction over inventory

• Experience over efficiency

This doesn’t mean every store becomes theatrical or extravagant. It means every store must be intentional. What problem does it solve? What emotion does it create? What memory does it leave behind?

Retailers who cannot clearly articulate the purpose of their physical space will be the first to rationalise their networks.

Starbucks Reserve Roastery New York

Prediction #2: Fewer Stores, Bigger Roles

Store networks will continue to shrink in number, but grow in strategic importance.

In 2026, retailers will stop measuring success by store count and start measuring it by store contribution. Each location will need to work harder, smarter and across more functions.

We will see:

Flagships acting as brand beacons and content engines

Suburban stores doubling as fulfilment hubs

Regional stores becoming community anchors

Pop-ups used as low-risk market testing tools

Not every store will do everything, but every store will do something meaningful.

The era of “cookie-cutter” rollouts is over. Localisation, catchment understanding and role clarity will separate resilient networks from expensive legacy footprints.

Pop Up Grocer, New York City

Prediction #3: Stores Will Become the Most Cost-Effective Customer Acquisition Channel

In a world of rising digital acquisition costs, physical retail is quietly becoming one of the most efficient ways to acquire high-value customers.

Brands are waking up to the fact that:

A store visit often converts faster than a click

In-store customers have higher lifetime value

Physical experiences build trust at a speed digital cannot match

In 2026, smart retailers will stop viewing stores as cost centres and start treating them as acquisition engines, particularly when supported by strong CRM, loyalty and data capture strategies.

The question won’t be “Can we afford stores?”

It will be “Can we afford not to have them?”

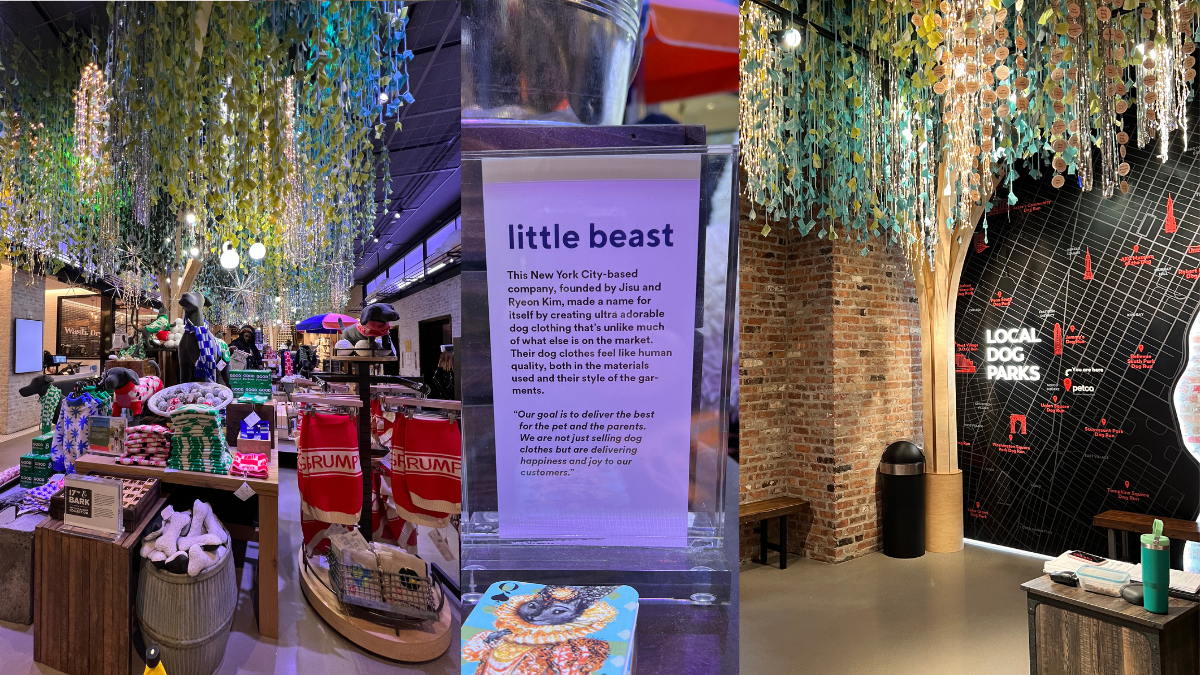

Petco Union Square, New York City

Prediction #4: Experience Will Shift from “Nice to Have” to Commercial Imperative

Retail experience has often been framed as a branding exercise. In 2026, it becomes a commercial necessity.

Experience will no longer be defined by:

Beautiful fit-outs alone

One-off activations

Social-media-friendly moments

Instead, it will be measured by:

Dwell time

Conversion uplift

Repeat visitation

Loyalty participation

Emotional connection

Retailers will invest less in novelty and more in meaningful, repeatable experiences that reflect how customers actually live, shop and interact with brands.

Experience will be quieter, more considered, and far more strategic.

Stoney Clover Lane, New York City

Prediction #5: Human Service Becomes the Ultimate Differentiator

As AI automates more of the transaction, human service becomes the defining edge of physical retail.

In 2026, customers won’t expect staff to simply process purchases. They’ll expect:

Expertise

Empathy

Guidance

Reassurance

Personalisation

The most successful retailers will invest heavily in:

Training, not just staffing

Empowerment, not scripts

Culture, not headcount

Stores will win not because they have more technology, but because they have better people, supported by smarter tools.

Retailers who treat frontline teams as interchangeable will struggle. Those who treat them as brand ambassadors will outperform.

Glossier, New York City

Prediction #6: Physical Retail Will Play a Bigger Role in Loyalty Than Digital

Loyalty in 2026 will not be driven by points alone. It will be driven by recognition, relevance and relationship - and physical retail is uniquely positioned to deliver all three.

Stores will increasingly become:

The place loyalty comes to life

The environment where value is felt, not just calculated

The human layer that digital loyalty lacks

We’ll see more:

In-store exclusives

Member-only experiences

Event-led loyalty engagement

Staff-enabled recognition

Retailers who integrate loyalty seamlessly across physical and digital touch-points will build stickier, more defensible customer bases.

Nordstrom Local West Village, New York City

Prediction #7: Local Relevance Will Outperform National Uniformity

In 2026, local beats large.

Consumers are increasingly drawn to brands that feel relevant to their community, their values and their lifestyle, not just their postcode.

Physical retail will lean harder into:

Localised assortments

Catchment-specific services

Community partnerships

Events that reflect local culture

Retailers who rely on national sameness will feel increasingly disconnected from their customers. Those who design stores with local context in mind will see stronger engagement, loyalty and advocacy.

Retail will start to feel more human again , and that’s a competitive advantage.

LEGO, New York City

Prediction #8: Stores Will Be Designed for Content, Not Just Customers

In 2026, stores won’t just serve customers, they’ll serve marketing, social and storytelling functions.

Physical retail will increasingly be designed to:

Generate content

Support creators and brand storytelling

Provide visual proof of brand values

Act as a stage, not just a space

The most successful retailers will think about:

Sightlines

Lighting

Flow

Moments worth capturing

Not for vanity, but because physical retail is now one of the most powerful brand signals available in a world saturated with digital noise.

APL, New York City

Prediction #9: Physical Retail Strategy Will Become a Board-Level Conversation

Perhaps the most important shift of all: in 2026, physical retail strategy will no longer sit in silos.

Decisions around store networks, formats, experience and investment will increasingly be made at board and executive level — because the stakes are higher.

Physical retail now impacts:

Brand perception

Financial performance

Customer acquisition

Data strategy

Supply chain and logistics

Long-term enterprise value

Retailers who treat physical retail as an operational afterthought will fall behind. Those who treat it as a strategic growth lever will lead.

In summary, The Store Is Still the Most Powerful Asset…If You Use It Properly

Physical retail in 2026 is not about nostalgia. It’s not about resisting change. And it’s certainly not about doing what worked five years ago.

It’s about clarity of purpose.

The retailers who will win are the ones who:

Understand their customer deeply

Are clear on the role each store plays

Invest in people, not just fit-outs

Design experiences with intent

Use physical retail as a strategic advantage, not a sunk cost

At RetailOasis, we work with retailers to redefine the role of physical retail - grounded in customer insight, commercial reality and long-term brand value.

If you’re questioning:

The future of your store network

Whether your stores are working hard enough

How physical retail fits into your broader growth strategy

Then it’s probably time for a deeper conversation.